Chapter 3: Developing Effective Consumer Strategies

Why Consumer Decisions Matter for Every Health Economy Stakeholder

Perhaps the most confounding quirk of the U.S. healthcare system is that the customer – the employer – is not the “consumer.” Cambridge Dictionary defines a consumer as “a person who buys goods or services for their own use.”1 While almost nothing happens in the health economy without a physician decision to treat or refer or prescribe or order, none of those things can happen without a consumer.

Health economy stakeholders reference “consumers” in a variety of ways. The profitability of most health economy stakeholders depends upon “members” or “enrollees,” individuals with some form of health insurance that provides (partial) reimbursement for the cost of the healthcare services they “consume.” Having decided to “consume” a healthcare product or service, the “member” or “enrollee” becomes a “patient” of one or more healthcare providers.

The nature of healthcare reimbursement creates paradoxical and occasionally perverse financial incentives. The Goldilocks principle characterizes the financial incentives of payers, which hope that “members” or “enrollees” consume just enough healthcare services to meet MLR requirements and detect potentially catastrophic conditions early enough to enable more affordable interventions. Conversely, the financial incentives of healthcare providers and life sciences firms are, on the margin, to deliver some sort of clinical intervention to every non-capitated “member” or “enrollee.” As a result, the financial incentive of every health economy stakeholder is for a consumer to make a choice that benefits the stakeholder, even though it might not benefit the consumer.

In summary, every health economy stakeholder’s financial performance depends upon the same consumer decision: consent to treatment.

Historically, consumers placed a high degree of trust in the healthcare system, especially upon becoming patients. Because of that trust, and because a third party underwrote most of the cost of care, consumers almost never refused consent to treatment.

In recent years, consumers have become less trusting of the healthcare system simultaneous with continuously increasing personal financial responsibility for the services they consume. Even if health economy stakeholders can regain consumer trust, there is little to suggest that the personal financial responsibility of consumers will decline. As a result, whether consumers consent to treatment will become the most important consumer decision in the U.S. economy.

What Health Economy Stakeholders Are Doing Wrong, and Why

Because most health economy stakeholders want patients to do something – have a visit, take a test, swallow a pill, receive an injection, undergo a surgery – that requires a physician order, their growth strategies unintentionally reveal two core misconceptions: that physicians are customers and patients are loyal. The assumption that patients will do whatever their physicians recommend explains the vacuous “consumer-focused strategies” of health economy stakeholders, like “patient portals” and “digital front doors” and “drug discount cards.”

Because patients can rarely unilaterally “consume” the most profitable healthcare services, it is fair to ask whether healthcare can ever be truly “consumer focused.” If it can, health economy stakeholders should understand what the most successful consumer-focused enterprises do.

The “first principles” of every truly consumer-focused enterprise is delivering value to their customers, which first requires knowing what consumers in a target market will consider valuable. Consumer-focused enterprises also understand their competitors: how much business the competition has, how and where to reach the customers of the competition, whether those customers are valuable and how to take those customers away from the competition. Most importantly, consumer-focused enterprises understand this insight from Peter Drucker:

A retailer may know a great deal about the people who shop at its stores. But no matter how successful, no retailer ever has more than a small fraction of the market as its customers; the great majority are noncustomers.2 (Emphasis added)

While consumer-focused enterprises theoretically desire to be a monopoly, they develop strategies knowing that they do not – and will never – have 100% of the business of their customers. Dr. Drucker’s observation about “a small fraction of the market” is something that most health economy stakeholders have never fully embraced or even understood, but it is foundational to developing innovative consumer strategies in a highly fragmented market like healthcare.

Consumer-focused enterprises are, as the phrase suggests, focused on a limited product mix and on ensuring that consumers understand that focus, which is why everyone knows that Whole Foods does not sell gasoline and that 7-Eleven does not sell Wagyu beef. In contrast, Fortune 100 pharmaceutical firms focus on multiple disease states and hospitals strive to be all things to all potential patients, branding every service line as a “Center of Excellence,” which is diametrically opposed to the “focused factory” strategy proposed by Professor Regina Herzlinger in her 1996 book “Market Driven Health Care.”

As discussed in the Introduction, the first mistake of every health economy stakeholder is failing to identify their real customer. As discussed in Chapter 1, the second mistake of every health economy stakeholder is overestimating their market share because of a failure to identify all relevant competitors. Having failed to identify their real customers and relevant competitors, health economy stakeholders are sorely challenged to know what their customers want and need and might acquire from someone else.

However, the most important – and underappreciated – difference between truly consumer-focused enterprises and health economy stakeholders is this:

Consumer-focused enterprises earn the business of consumers, while health economy stakeholders attempt to compel it.

Consumer-focused enterprises try to entice individual consumers by offering value that large numbers of consumers find appealing, like Amazon Prime. Is the goal of Amazon Prime to draw a customer into an ecosystem of products that Amazon sells? Of course, but Amazon is trying to influence behavior, which is quite different than trying to compel it. The former is consumer-focused; the latter is not.

In contrast, the behavior of health economy stakeholders suggests that they view employers not as customers but as facilitators, a means to an end, as either the aggregator of “risk pools” or the underwriter of the cost of those risk pools or both. Health economy stakeholders then attempt to control those “risk pools” in a variety of ways: narrow networks, benefit design, pharmacy benefit managers, EMR portals, utilization management, group purchasing contracts, etc. The only exception is Medicare Advantage, the design of which forces payers to compete annually based on network and benefit designs to entice elderly consumers to enroll.

Instead of trying to control consumer behavior through opaque contractual relationships, health economy stakeholders should focus on delivering what employers and patients want and need: value for money.

The most important elements of value in healthcare services are cost, quality, safety and convenience. Historically, health economy stakeholders in the U.S. have emphasized quality despite its rather subjective nature. In contrast, the British are refreshingly honest about the challenges of defining a “quality outcome” in determining value:

Any assessment of a health service ought to examine indicators of the value of the ‘output’ it creates. Traditionally, two classes of outcome are considered important in healthcare: clinical outcomes expressed in terms of the health gains created by the system, and the quality of the patient experience, independent of health outcomes, expressed in concepts such as ease of access to care and responsiveness.

Some health outcomes indicators – such as life expectancy rates, infant mortality rates and cancer mortality rates – are available. However, improvements in these are a function of many factors over which the NHS often has little influence. The relative scarcity of readily accessible outcome data specific to the NHS forces any analysis to rely heavily on process indicators, on the assumption that they provide a reasonable proxy for health outcomes.3 (Emphasis added)

Knowledgeable observers of the U.S. healthcare system know that the British are, as they say, spot on, affirming CMS’s significant reliance on process measures and patient experience in quality reporting. While the relative difference between providers on common quality measures has narrowed in the past 15 years, the mean value of almost every CMS quality measure is astonishingly low.

What is less frequently discussed is the fact that the importance of quality as an element of value is highly variable depending on the type of care. Quality, which is critically important in neurosurgery, is almost irrelevant in an ankle X-ray if the patient doesn’t move.

As a result, developing truly consumer-focused strategies in healthcare requires a dynamic definition of value for money that depends on the type of product or service being delivered, the complexity of the product or service and the relative and comparative price of that product or service, as well as the relative and comparative price of substitute goods.

As discussed in the Introduction to the Field Guide, quality would undoubtedly increase if mortality decreased, a subject the industry is loath to discuss. In the absence of quantifiable and easily understood quality outcomes other than mortality, influencing consumer decisions to consent to treatment for elective services can be reduced to these two general principles:

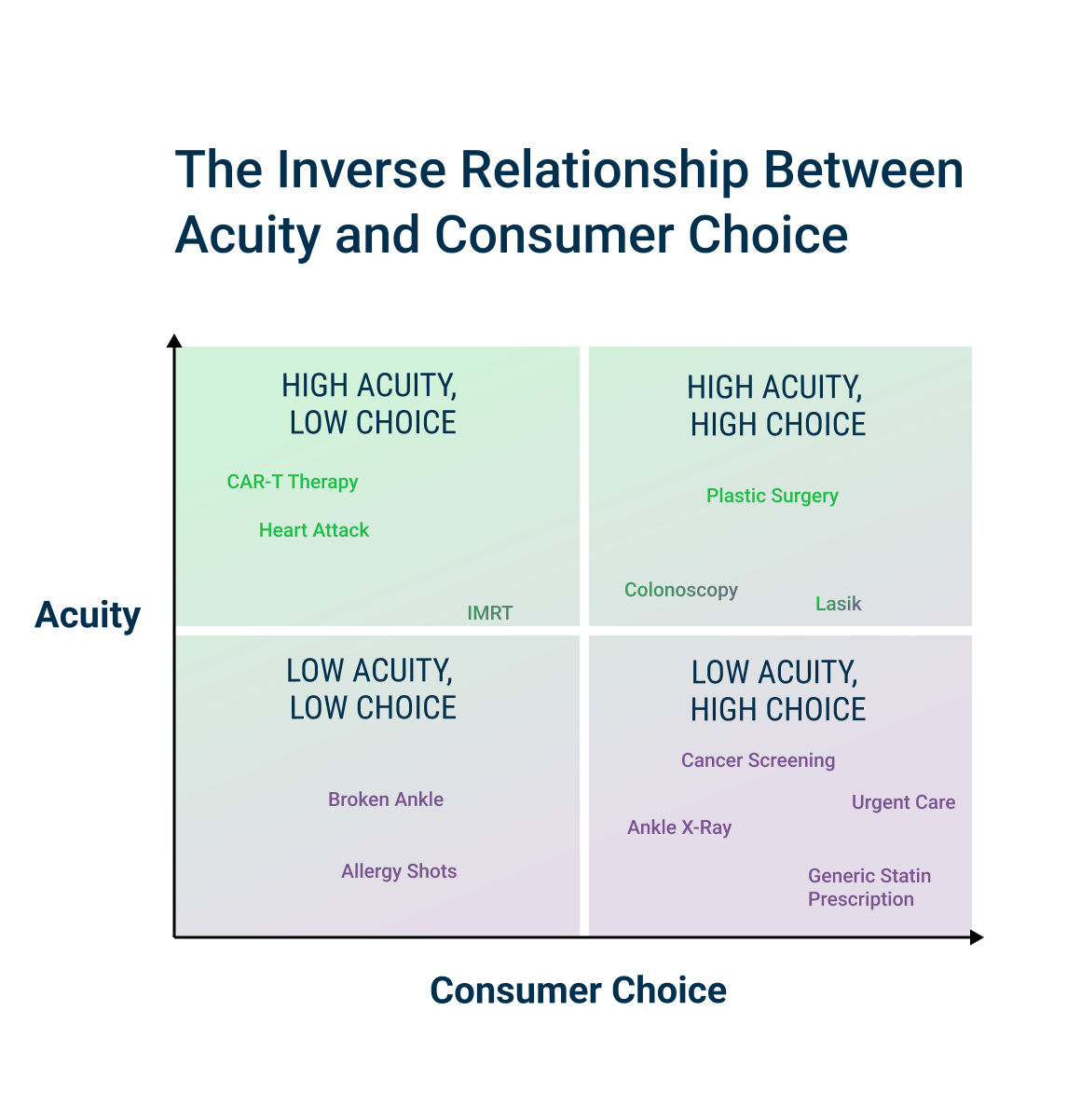

As acuity increases, consumer preference about location and convenience decreases.

As price increases, the more consumers will consider postponing elective and even emergent care.

The foundation of every successful consumer-focused strategy ultimately depends upon delivering value for money to the customer. Period.

In healthcare, stakeholders can deliver value for money to the customer – the employer – in three ways:

- Better than average quality at a price at or near the median market rate

- Average quality at a price that is below the median market rate

- Better than average quality at a price that is below the median market rate

While any “consumer-focused” strategy that does not deliver value for money to the customer is ultimately worthless, consumer-focused strategies can help influence a consumer decision to consent to treatment. This Chapter focuses on use cases for which consumer psychology is most likely to influence a consumer’s consent to treatment. Chapter 4 leverages health plan price transparency data to reveal how negotiated rates can influence a consumer’s consent to treatment. Where quality is equal, competing on convenience and price for low acuity care is a key consumer strategy.

The Questions Every Stakeholder Should Answer

- What is the total demand for healthcare products and services from consumers in a defined geographic market? What is the future demand for those products and services?

- What healthcare products and services do the consumers in the target market need – and what do they want? How do these services differ across different consumer segments?

- How do the consumers in the target market quantify value?

- What “share of care” does the stakeholder’s organization capture? Which services are most profitable? Which services are least profitable?

- For which products or services does the stakeholder offer higher value than competitors? For which products or services does the stakeholder offer lower value than competitors?

- What does the current and future policy and payment landscape signal for the growth opportunities and constraints for the stakeholder’s products and services?

Explore strategies for each health economy stakeholder:

Footnotes

-

https://dictionary.cambridge.org/us/dictionary/english/consumer ↩

-

Drucker, P. (2001) Management Challenges in the 21st Century. Harper Business. ↩

-

https://www.health.org.uk/publications/value-for-money-in-the-english-nhs-summary-of-the-evidence ↩