Chapter 5: Capital Allocation

Why Capital Allocation Matters for Every Health Economy Stakeholder

As befits the largest sector of the largest economy in the world, the U.S. healthcare system consumes capital voraciously. The phrase “capital allocation” is frequently used as a synonym for “capital expenditures,” i.e., investments in fixed assets such as hospitals, surgery centers, imaging centers and medical office buildings. A broader definition that applies to all health economy stakeholders is this:

Capital allocation means distributing and investing a company’s financial resources in ways that will increase its efficiency and maximize its profits.1

As such, capital allocation activities may include research and development (R&D) for drug discovery, new market entry and development, mergers and acquisitions (M&A), capital equipment, product development, etc. For providers, personnel costs and maintenance for property, plant and equipment (PP&E) are also significant considerations in capital allocation decisions. Even the largest and most profitable health economy stakeholders lack sufficient capital to invest in every compelling opportunity.

As noted in Chapter 4, Peter Drucker emphasized this fact:

And high profit margins do not equal maximum profits. Total profit is profit margin multiplied by turnover. Maximum profit is thus obtained by the profit margin that yields the largest total profit flow, and that is usually the profit margin that produces optimum market standing.” 2

Similarly, high rates of return on invested capital do not necessarily represent the maximum return on invested capital, which is measured by economic value added (EVA), also called economic profit.3 EVA measures the profitability – or lack thereof – of capital allocation by quantifying the profit generated from a project in comparison to the weighted average cost of capital of that project. 3

What Health Economy Stakeholders Are Doing Wrong, and Why

The concept of “return on invested capital” implicitly recognizes that the cost of capital requires a return and that anyone allocating capital resources – whether classified as an operating or capital expense – should focus on the value received in return, whether a new therapy, diagnostic tool, medical device, surgical suite, emergency department, ambulatory complex or hospital. Because different capital allocations generate different levels of return, it is essential for health economy stakeholders to invest in strategies that are most likely to generate the highest EVA.

As noted in Chapter 1, no stakeholder can compete effectively without understanding its competitors and their market share – who they are, where they operate and how much business they have. It is therefore problematic that every health economy stakeholder fundamentally misunderstands market share since no stakeholder knows how many competitors exist. It is seemingly self-evident that forecasting a return on invested capital is impossible without first understanding the competitive landscape for that project, whether a new product, service, building or piece of capital equipment.

Moreover, capital allocation is effectively binary, representing an investment either to maintain the status quo or to grow. Although each of these choices reflects a foundational belief in future demand within a market, most stakeholders have for decades relied on a national demand forecast model to allocate capital locally. Shockingly, some stakeholders don’t rely on any demand forecast model.

Beyond general principles, health economy stakeholders must evaluate their capital allocation strategies in light of two emerging trends in the health economy that are existential threats to existing business models. First, while much has been written about the emergence of retail-based healthcare business models, particularly by Amazon and Walmart, little has been written about the disintermediating effect of those business models on traditional healthcare providers. Second, health economy stakeholders are generally unaware of the emerging existential threat to traditional healthcare providers whose financial success depends upon diagnostic and interventional procedures from pharmaceutical firms offering therapeutic treatments that are effectively substitute goods.

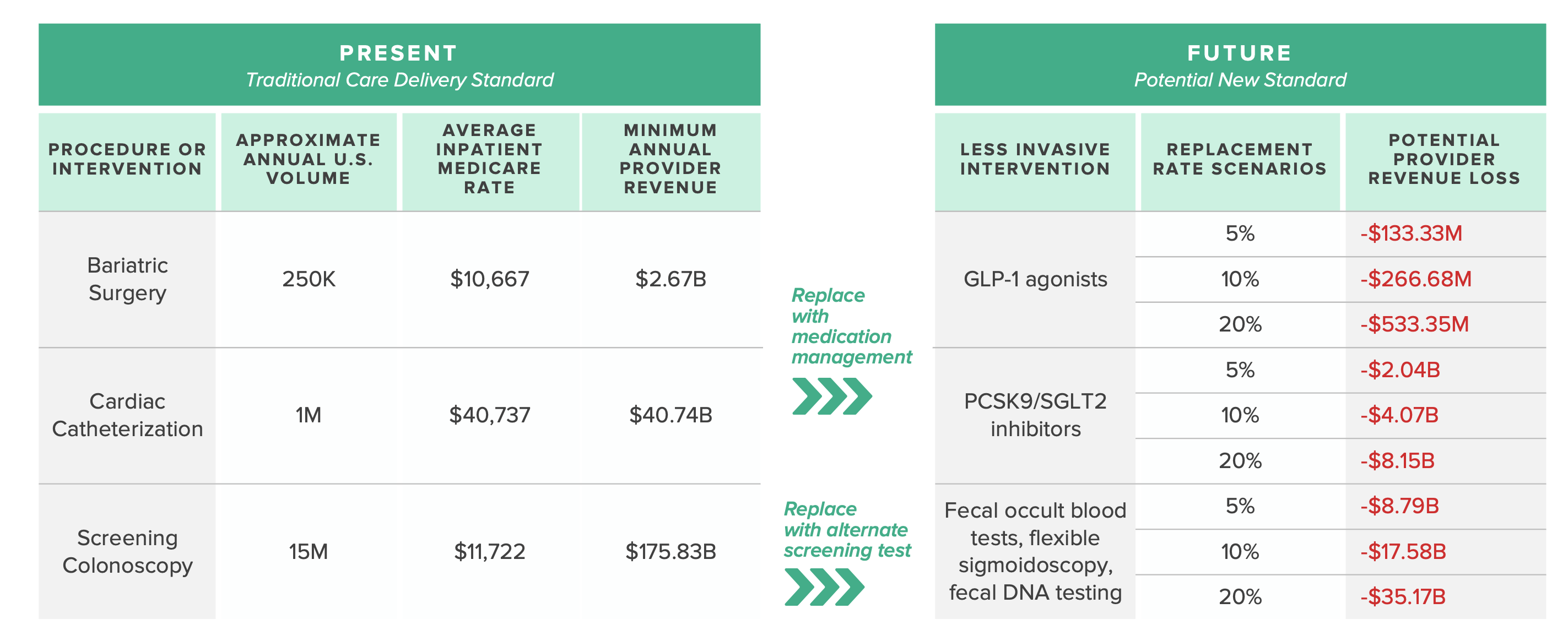

Current and Future Scenarios for Select Surgical Procedures with Less Invasive Therapeutic Alternatives

Source: Trilliant Health national all-payer claims database; Centers for Medicare and Medicaid Services Inpatient Prospective Payment System

For decades, health economy stakeholders have allocated capital with the “Field of Dreams” mindset – “if you build it, they will come” – because of an unsophisticated reliance on demographic trends, national demand forecast models and anecdote. However, just as demography is not necessarily destiny, burden of disease is not necessarily correlated with demand for healthcare products and services. And, in healthcare, past is not prologue.

In the future, the market share – and in some cases, survival – of every health economy stakeholder will be determined primarily by its return on invested capital.

The Questions Every Health Economy Stakeholder Should Answer

The formula to calculate a return on invested capital explicitly recognizes that generating a return on invested capital takes time. As a result, before even considering the allocation of capital in a facility or medical device or pharmaceutical agent or value-based care program, stakeholders should have answered the applicable questions set forth previously in Chapters 1-4.

Having suitably addressed issues of competitive landscape and future demand, stakeholders should answer the following questions:

- What is the stakeholder’s average annual capital budget for the past five years? Does the stakeholder anticipate that amount will increase, decrease or remain the same over the next five years?

- How much of the stakeholder’s average annual capital budget should be allocated to maintenance of existing capital infrastructure or ongoing research and development projects?

- Of the potential capital investment projects:

- What is the projected EVA of each project?

- What is the weighted average cost of capital of each project?

- What is the actual EVA of similar projects in which the stakeholder has previously invested?

- Does the stakeholder have a competitive advantage in the markets in which the capital projects are planned? If so, is that competitive advantage sustainable?

- Do competitors offer substitute products or services for the stakeholder’s proposed capital project?

- What is the projected EVA of all potential projects in the stakeholder’s most profitable markets versus their least profitable markets?

- Which projects will enable the stakeholder to increase its market share? Which projects are necessary for the stakeholder to maintain its market share?

- Does the stakeholder have a long-term commitment to the market in which a capital project is proposed?