Physician Strategies for Life Sciences Firms

No health economy stakeholder is more dependent on physician decisions than life sciences firms. While approximately half of all inpatient admissions originate in the emergency department, and payers can paradoxically benefit from the absence of a physician decision, a physician order is required for a prescription to be dispensed and or a medical device to be implanted. As a result, understanding physician specialties, individual physician prescribing patterns and physician loyalty is essential to the network performance of every life sciences firm.

Stakeholders at life sciences firms must answer the following questions when developing go-to-market (GTM) strategies for commercialization:

- Which healthcare providers in the target market, including facilities, physicians, allied health professionals, “payviders” and digital health firms, might adopt or prescribe a new device or therapeutic based on historical utilization, patient panels, cost, demographics and psychographics?

- What is the stakeholder’s market share with each healthcare provider in the target market?

- Where does the target population for the device or therapeutic live? What are the distinct utilization patterns, needs and preferences of the target population?

- Are there unique requirements for the delivery of the device or therapeutic, such as CAR-T therapies?

- How will the device or therapeutic affect existing VBC arrangements?

- What competitive devices or therapeutics do target healthcare providers currently utilize?

- Which providers are likely to be key opinion leaders (KOLs) in certain markets or segments, given their referral relationships and affiliations?

- How will current and future policy and payment trends influence the growth opportunities for the stakeholder’s products in the target market?

Post-launch, life sciences firms can monitor the adoption of their products across these provider networks, adjusting their sales and marketing strategies accordingly. Questions might include:

- How does adoption vary across segments of the provider network by specialty or payer mix?

- What are the characteristics of providers and patients in markets that adopt new devices or therapeutics at an accelerated pace?

- What is the expected rate of change? How will the market for certain therapeutics change over time? Which therapeutics or procedures will decline in share/utilization over the next 5-10 years?

Use Case: Targeting Provider Organizations for Go-to-Market Strategies

To develop effective go-to-market (GTM) strategies, life sciences firms must first understand the market share of healthcare providers in the target geography. A typical GTM strategy might target a handful of the most well-known healthcare providers in the market, but those providers make up only a fraction of total volumes for many service lines.

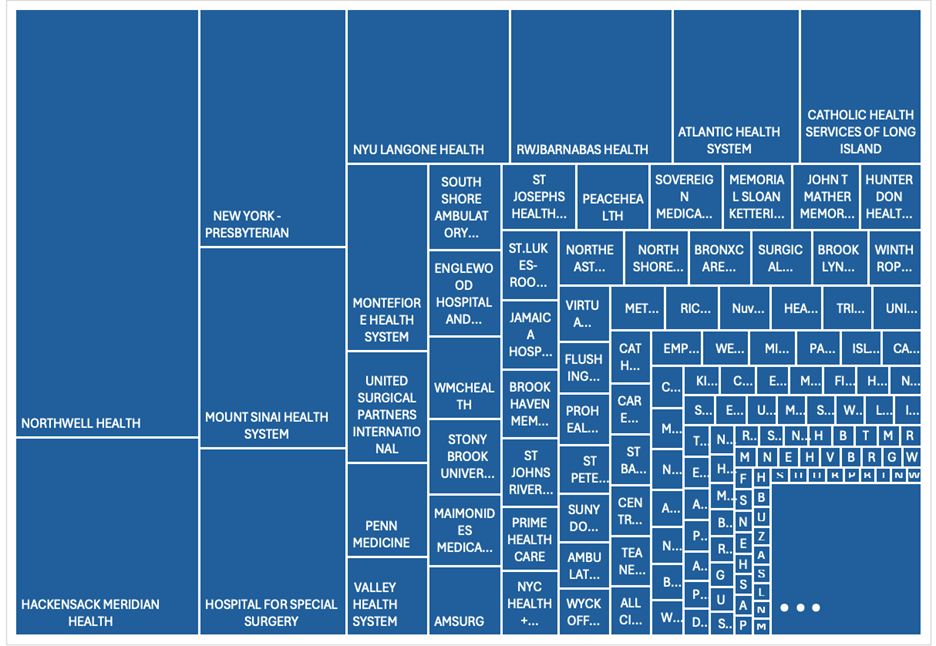

In this example, using a combination of provider directory and utilization data, in the New York-Newark-Jersey City, NY-NJ-PA CBSA, the health system with the largest volume of total orthopedic surgeries has only 14.2% of the total addressable market (TAM). Moreover, the top five healthcare provider organizations have, in aggregate, only one-third of the market TAM, the balance of which is delivered by more than 200 other providers.

With an understanding of the TAM and each provider’s market share, life sciences firms can develop strategies to capture market share not only from the market’s large health systems, but also from the many smaller hospitals, ambulatory facilities and physician groups that, in aggregate, represent significant revenue potential.

In this example, using a combination of provider directory and utilization data, orthopedic market share in the New York CBSA is calculated for the hundreds of smaller healthcare providers in the market.

Orthopedic Surgical Market Share Across the New York-Newark-Jersey City, NY-NJ-PA CBSA, 2021

Source: Trilliant Health Provider Directory and national all-payer claims database

To target healthcare providers effectively, life sciences firms must understand how provider organizations operate differently within the same market. Life sciences firms should evaluate partnerships with a deep understanding of each potential partner’s strengths, weaknesses and pain points.

In this example, using a combination of provider directory, utilization and reimbursement data, an analysis of surgical volumes reveals that “Health System D,” one of the five largest providers of orthopedic services in the New York CBSA, has lost significant market share over a four-year period. The decline in surgical volume varied across procedures, with a slight increase (3.1%) in Other Surgical Procedures on the Hands and Fingers alongside a sharp decline (-14.1%) for Repair, Revision and/or Reconstruction Procedures on the Foot and Toes.

In this example, using provider directory, utilization and reimbursement data, surgical procedures on the foot and toes are revealed to make up a small portion of Health System D’s overall revenue and are unlikely to offset significant declines in other services. With insight into a provider organization’s revenue and volume trends, life sciences firms can develop targeted go-to-market strategies, with tailored outreach to align with each provider organization’s priorities.

Steps to Target Health Systems and Facility Partners

- Planning and Research

Analyze internal sales data to identify patterns in customer behavior, such as the volume and frequency of purchases. Understand the relative reimbursement and profitability of the target customers for the applicable device or therapeutic. Segment the data by geographic area, facility type (hospitals, surgery centers, clinics, etc.) and service line segment (orthopedics, cardiology, etc.) to prioritize areas of strength and potential growth based on strategic fit, revenue potential and feasibility for expansion.

- Define Target Segments and Personas

Identify key decision-makers and influencers within the target market who order or utilize medical devices. Segment the market opportunity based on key growth factors such as facility size, specialty focus, physician group utilization and purchasing behaviors. Develop buyer personas representing the key decision-makers and influencers within target facilities and physician groups likely to be interested in target medical devices.

- Identify Partnership Opportunities

Evaluate potential partnership opportunities with facilities and physician groups that align with key business objectives and target growth segments. Augment internal data with external market data to gain a comprehensive understanding of market trends, competitor activities and potential partnership opportunities.

- Facility Targeting

Identify facilities with high growth potential and demonstrated evidence of providing better than average quality. Analyze key metrics to define strengths, weaknesses and pain points of each potential facility partner. Key facility metrics include:

- Bed Size

- System Affiliation

- Operating Margin

- Market Share Trend

- Service Mix and Procedure Volume

- Payer Mix

- Employed Provider Network

- Affiliated Provider Network

- Develop Data-Driven Marketing and Sales Strategy

Allocate sales and marketing resources as well as operational investments based on the potential return on investment and identified growth prospects. Create targeted marketing and sales strategies tailored to the unique needs and characteristics of each facility and physician opportunity. Customize messaging, value propositions and promotional activities to resonate with key decision-makers within each target segment.

- Monitor Market Performance

Estalish metrics to monitor the performance of growth initiatives in the target market and service line segment. Continuously track sales performance, market share, customer feedback and other key indicators to assess effectiveness and make data-driven adjustments as needed.

Use Case: Targeting Individual Physicians

Life sciences firms should target physicians based upon an analysis of volumes, payer mix and relative reimbursement for the applicable device or therapeutic.

In this example, using a combination of provider directory and utilization data, the orthopedic surgeons with the highest volume of hip and knee replacements in the Los Angeles-Long Beach-Anaheim, CA CBSA are listed, led by “Surgeon A,” who performed 684 procedures in 2022.

With a more detailed understanding of each surgeon’s practice patterns, life sciences firms can develop more targeted outreach strategies and quantify the potential revenue impact of partnerships. In this example, using a combination of provider directory and utilization data, Surgeon A is shown to perform knee and hip replacements most frequently in an inpatient setting. However, Surgeon A has a higher proportion of traditional Medicare cases, which are often reimbursed at a lower rate.

Steps to Target Individual Physicians

- Planning and Research

Analyze internal sales data to identify patterns in customer behavior, such as device or therapeutic utilization volume and frequency. Understand the relative reimbursement and profitability of the target customers for the applicable device or therapeutic. Segment the data by geographic area, facility type (hospitals, surgery center, clinics, etc.) and service line segment (orthopedics, cardiology, etc.) to prioritize areas of strength and potential growth based on strategic fit, revenue potential and feasibility for expansion.

- Define Target Segments and Personas

Identify key decision-makers and influencers within the target market who order or utilize medical devices or therapeutics. Segment the market opportunity based on key growth factors such as facility size, specialty focus, physician group utilization and purchasing behaviors. Develop buyer personas representing the key decision-makers and influencers within target facilities and physician groups who are likely to be interested in your medical devices.

- Identify Partnership Opportunities

Evaluate potential partnership opportunities with facilities and physician groups that align with key business objectives and target growth segments. Augment internal data with external market data to gain a comprehensive understanding of market trends, competitor activities and potential partnership opportunities.

- Provider Targeting

Identify high-performing providers based on service mix, competitive market position and facility affiliation. Assess utilization rates and adoption rates to target sales efforts around the highest-volume physicians for relevant services, also consider how practice patterns might impact revenue. Research each physician to learn more about their background and medical training. Key physician metrics include:

- Specialty

- Group Affiliation

- Age

- Medical Training

- Payer Mix

- Procedure Volume by Facility

- Medical Device Utilization

- Facility and Provider Referral Relationships

- Develop Data-Driven Marketing and Sales Strategy

Allocate sales and marketing resources as well as operational investments based on the potential return on investment and identified growth prospects. Create targeted marketing and sales strategies tailored to the unique needs and characteristics of each facility and physician opportunity. Customize messaging, value propositions and promotional activities to resonate with key decision-makers within each target segment.

- Monitor Market Performance

Establish metrics to monitor the performance of growth initiatives in the target market and service line segment. Continuously track sales performance, market share, customer feedback and other key indicators to assess effectiveness and make data-driven adjustments as needed.