Foreword: Winning a Losing Game

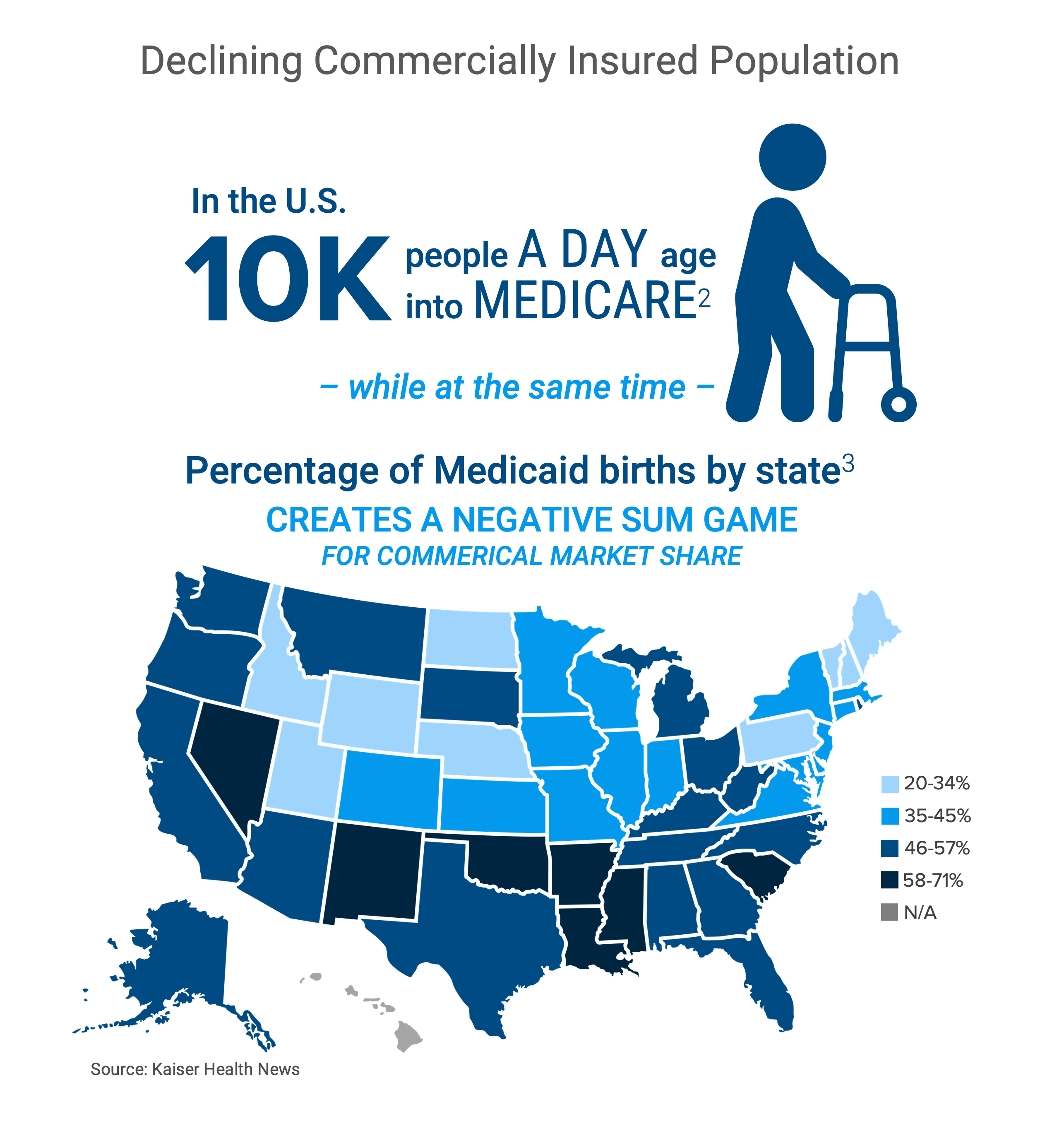

Despite the vast size of the U.S. health economy, changing demographics, shifting economic conditions, increasing patient deductibles and a burdensome regulatory environment have created myriad financial and operational challenges for health economy stakeholders. New market entrants like Amazon and Walmart have begun to disintermediate traditional stakeholders by deploying closed-loop business models offering consumers an array of choices for their healthcare needs, even as the supply of commercially insured patients – the very lifeblood of the U.S. healthcare system – is declining. The “silver tsunami” of 10,000 Baby Boomers who daily become Medicare-eligible are being “replaced” by half as many daily births to commercially insured women, and the U.S. birth rate has declined by more than 50% since 1950.

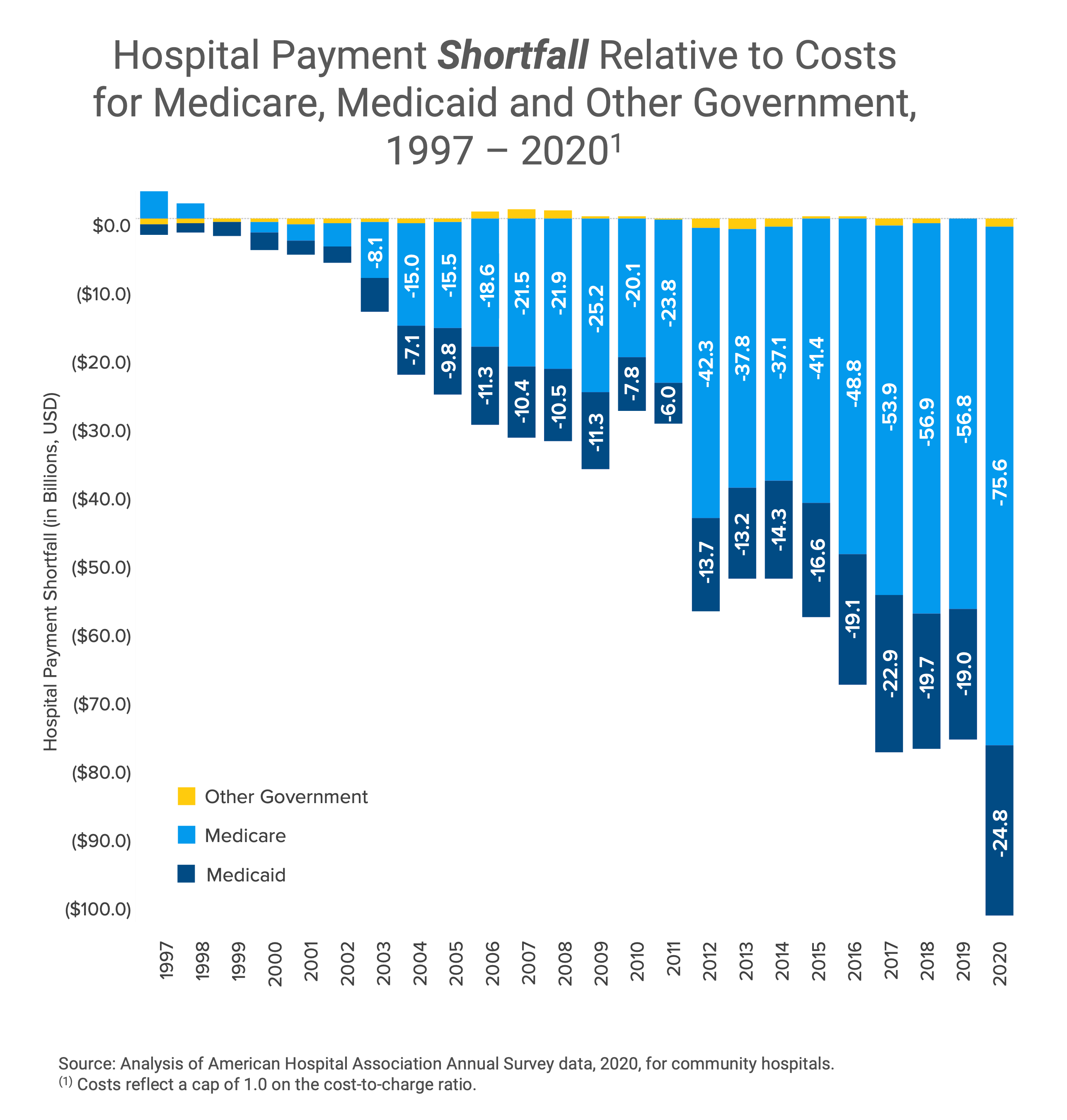

The combination of the secular decline in the number of commercially insured patients and the inability of most providers to generate positive operating margins from reimbursement for Medicare and Medicaid beneficiaries means that, in aggregate, the U.S. healthcare system is a negative-sum game. Because of the 75-year decline in the U.S. birth rate, healthcare will never again be even a zero-sum game, much less a positive-sum game. The repercussions of these trends have already begun to manifest in rural America, where 191 hospitals have closed since January 2005.1

The Challenge: Healthcare is a Negative-Sum Game

Stein’s Law states that “if something cannot go on forever, it will stop.”2 At some point, the U.S. healthcare system will be incapable of ignoring the fundamental principles of economics: demand, supply and yield.

Demand for acute healthcare services has been declining since 2008, while demand for ambulatory healthcare services has been relatively flat throughout the past decade. The response by Federal, state and local governments to the SARS-CoV-2 pandemic simultaneously dampened demand for healthcare services while accelerating the migration of care delivery to lower acuity, lower cost settings. More recently, consumers report delaying care because of unaffordability, with almost half worried about their ability to pay deductibles.3

Supply has long been artificially constrained by medieval guild-like licensure and accreditation standards, and the combination of increased administrative burdens coupled with forced adoption of poorly designed electronic medical records has catalyzed increasing clinician burnout. Meanwhile, the recent expansion of large retailers into primary care services has increased the competition for a declining supply of providers.

Yield, in the form of both higher prices and higher average unit reimbursement, is imperiled by a declining mix of commercially insured patients as Medicare and Medicaid enrollment increases. Yield is also constrained by claim denials from commercial payers, estimated to be as high as 11%, and “payer takeback,” estimated to be as high as 1.8% of debit accounts receivable.4 With emerging evidence from health plan price transparency of wide intra-market price spreads that are not correlated with higher quality, the history of free market capitalism suggests that outlier rates will regress to the recently revealed mean. Even though the health economy is more fairly characterized as mixed capitalism, the fiduciary duties of employer CFOs obligate them not to waste corporate resources on healthcare benefits, which should ensure this regression to the mean occurs. A lawsuit recently filed by an employee of Johnson & Johnson may be a catalyst for employers to manage the cost of health benefits.

Game theory is infrequently, if ever, discussed in the health economy, but nothing will have a more profound effect on the financial performance of health economy stakeholders in the next 20 years.

“The most difficult problems are negative-sum situations, where the pie is shrinking. In the end, the gains and losses will all add up to less than zero. This means that the only way for a party to maintain its position is to take something from another party, and even if everyone takes his or her share of the ‘losses,’ everyone still loses in comparison to what they currently have or really need. This type of situation often sparks serious competition.”5 (Emphasis added)

In the coming decade, the losers of healthcare’s negative-sum game will vastly outnumber the winners.

The rules of negative-sum games are immutable, which means that the status quo is unsustainable and, therefore, a losing strategy. In the words of General Erik Shinseki, “If you don’t like change, you’ll like irrelevance even less.”

There is no way to win a losing game without competing, but there are several ways to compete effectively: winning key battles, cutting losses early, losing less frequently and losing by a smaller margin than the competition. However, winning more or losing less than the competition is virtually impossible without having – and acting upon – accurate and actionable information.

Negative-sum games are stressful, and stress reveals weakness, and weakness exposes vulnerabilities. Every health economy stakeholder who doesn’t know who their customers are, what those customers want and how to deliver value to those customers is imperiled. And every health economy stakeholder who doesn’t know the identities and vulnerabilities of their competitors will not win as many competitive battles as they could or should or desperately need.

This guide offers evidence-based strategies and tactics to win healthcare’s negative-sum game for every health economy stakeholder, whether a provider, payer, life sciences firm or employer. The guide is divided into chapters, and each chapter follows this framework:

- An overview of a key concept that applies to every health economy stakeholder

- The implications of the concept for specific health economy stakeholders

- The key questions that every stakeholder must answer

- Anonymized examples of actual use cases developed for Fortune 100 life sciences firms, U.S. News & World Report Best Hospitals, national payers and publicly traded ambulatory providers, among others

Because maintaining the status quo is septic, every stakeholder must think critically and act differently to survive.

Compete to win,

Hal Andrews

President and Chief Executive Officer

Trilliant Health

Footnotes

-

https://www.shepscenter.unc.edu/programs-projects/rural-health/rural-hospital-closures/ ↩

-

https://www.cepweb.org/if-something-cannot-go-on-forever-it-will-stop/ ↩

-

https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/ ↩

-

hospital-double-whammy-less-cash-in-more-cash-out-chc2305-001b.pdf (crowe.com) ↩